In today’s increasingly digital marketplace, the need for secure and flexible payment solutions is more critical than ever. For businesses categorized as “high risk” by traditional banking standards, finding a reliable partner for processing payments can be a daunting task. Enter high risk merchant highriskpay.com, a leading provider of high-risk merchant accounts tailored to meet the unique needs of these businesses. HighRiskPay.com offers a beacon of hope, providing robust, secure, and flexible payment solutions that empower high-risk businesses to thrive without fear of payment processing challenges.

Why High-Risk Merchant Accounts Are Necessary

Businesses classified as high risk often face significant challenges in securing merchant services. This designation can come from various factors, including industry type, financial history, and the potential for high chargeback rates. High-risk merchant accounts are specially designed to accommodate the complexities and risks associated with these businesses, offering a path to secure payment processing. Here are the main reasons why obtaining a high-risk merchant account is crucial for your business:

- Improved Chargeback Protection: High-risk merchant accounts come with enhanced chargeback protection, helping businesses manage and reduce the impact of chargebacks on their operations.

- Access to Global Markets: With a high-risk account, businesses can accept payments in multiple currencies, expanding their reach into international markets.

- Flexible Payment Solutions: High-risk accounts offer a variety of payment gateways and solutions, catering to businesses with unique needs or those selling products and services online.

- Increased Security Measures: Providers of high-risk merchant accounts, like HighRiskPay.com, implement advanced security protocols to protect sensitive payment information and reduce the risk of fraud.

Features of High-Risk Merchant Accounts at HighRiskPay.com

HighRiskPay.com stands out as a premier provider of high-risk merchant accounts due to its comprehensive range of features designed to support the unique needs of high-risk businesses. These features include:

- Customized Payment Solutions: Tailored payment processing solutions that align with your business model and customer preferences.

- Advanced Fraud Protection: Cutting-edge technology to detect and prevent fraudulent transactions, safeguarding your business and your customers.

- 24/7 Customer Support: Round-the-clock support from knowledgeable professionals ready to assist with any questions or issues.

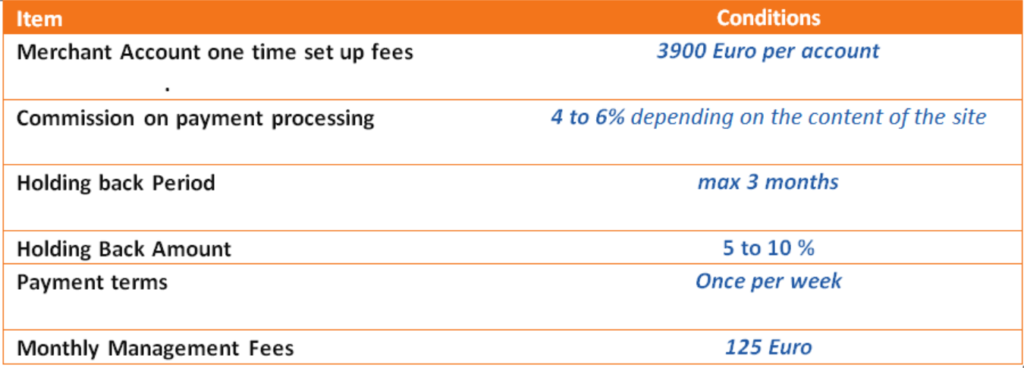

- Competitive Pricing: Transparent and competitive pricing structures with no hidden fees, ensuring that businesses can plan their finances effectively.

- Fast Approval Process: A streamlined application and approval process, getting your business up and running with high-risk merchant services quickly.

How to Apply for a High-Risk Merchant Account with HighRiskPay.com

Securing a high-risk merchant account with HighRiskPay.com is a straightforward process:

- Complete the Online Application: Fill out the application form on HighRiskPay.com, providing details about your business and financial history.

- Submit Necessary Documentation: Provide the required documents, which may include business licenses, bank statements, and identification for business owners.

- Review and Approval: HighRiskPay.com will review your application and conduct any necessary due diligence checks. This process is swift, with most accounts approved within a few business days.

- Set Up Your Payment Gateway: Once approved, you can set up your payment gateway and start accepting payments securely.

Comparison: HighRiskPay.com Versus Other High-Risk Merchant Account Providers

When comparing HighRiskPay.com with other providers, several key differences stand out:

- Customer Service: HighRiskPay.com’s commitment to exceptional customer service ensures that you have the support you need when you need it.

- Flexibility and Adaptability: HighRiskPay.com offers more flexible and adaptable payment solutions, catering to a wider range of high-risk businesses.

- Security Measures: With advanced fraud protection measures, HighRiskPay.com provides superior security compared to many competitors.

Streamlined Integration with E-commerce Platforms

Streamlined Integration with E-commerce Platforms: HighRiskPay.com offers seamless integration with various e-commerce platforms, enhancing customer shopping experiences and reducing time and technical effort for businesses. This feature enhances the checkout process, reduces time and effort required for setup and management, and allows businesses to focus on growing operations.

(FAQs)

Q: What makes a business “high risk”?

A: Factors include industry type, financial history, and the potential for high chargeback rates.

Q: How long does it take to get approved for a high-risk merchant account with HighRiskPay.com?

A: Most accounts are approved within a few business days, following a thorough review of the application and necessary documentation.

Q: Can I accept international payments with a HighRiskPay.com merchant account?

A: Yes, HighRiskPay.com supports multi-currency transactions, allowing businesses to accept payments from customers worldwide.

Conclusion

For businesses navigating the complexities of the high-risk marketplace, partnering with HighRiskPay.com for your merchant services needs can provide a stable, secure foundation for payment processing. With its comprehensive suite of features, competitive pricing, and unwavering customer support, HighRiskPay.com stands as a beacon of reliability for high-risk businesses aiming for growth and success.

People Read Also: Mastering HR Hiring: Strategies for Effective Recruitment – Your Ultimate Guide